- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

GE Vernova Soars 90% YTD. Here’s Why GEV Stock’s Rally Isn’t Over.

GE Vernova (GEV) stock has soared nearly 90% year-to-date. Moreover, it has gained about 163% in a year. The rally in GEV stock is driven by the solid demand for its products and services, led by tailwinds stemming from electrification and decarbonization.

GEV provides equipment, technologies, and services needed for generating, transferring, and storing electricity. As the demand for energy rises, GEV stands to benefit from rising investments in infrastructure projects, particularly those focused on electrification and decarbonization. The strong demand environment adds optimism around the stock, suggesting room for further upside. Moreover, GEV’s current valuation implies that the rally is far from over.

GEV Is Riding the Wave of Energy Demand

Global electricity demand is increasing rapidly, driven by advancements in technology and the transition to clean energy sources. The surge in data centers required to power artificial intelligence (AI), alongside grid modernization efforts and the shift toward low-carbon energy, indicates solid end-market demand for GEV’s products and services. Furthermore, increased profitable volume, higher productivity savings, and a favorable pricing environment will likely boost its earnings and share price.

GEV continues to deliver strong financials with its latest Q2 results registering continued orders and revenue growth and margin expansion. GE Vernova posted robust performance across both equipment and services. The company’s equipment backlog climbed to $50 billion, up from $45 billion in the prior year quarter and about $7 billion higher over the first half of 2024. Service backlog added another $1 billion, bringing the total backlog to $129 billion. Notably, a growing backlog at expanding margins lays the foundation for solid revenue and earnings growth in the future.

GEV’s Gas Power Business Is Firing on All Cylinders

GE Vernova’s latest quarter reflects the strong and sustained demand for its Gas Power business, with new contracts and services momentum signaling a robust growth trajectory. Power orders surged 44% year over year, driven by solid demand for heavy-duty and aeroderivative gas turbines. The contrast with last year is stark as bookings for aeroderivative units jumped from just one to 27, highlighting how the energy-intensive requirements of data centers are creating incremental demand.

Importantly, the strength in demand is not confined to new gas turbines. Services remain a powerful growth driver as customers continue to reinvest in their existing fleets.

The company’s backlog remained steady at 29 gigawatts, while slot reservation agreements, a mechanism that locks in future demand, expanded meaningfully from 21 gigawatts to 25 gigawatts in the quarter. Altogether, the combined tally of backlog and SRAs rose to 55 gigawatts. Management remains confident that it will reach at least 60 gigawatts by year-end, supported by higher turbine pricing, strong global demand, and improved margins. This growth is also expected to provide momentum well into 2026.

With such broad-based strength across equipment and services, GE Vernova is working aggressively to ramp up production capacity. The company is well-placed to capture elevated demand and deliver solid growth, supported by a diversified mix of gas, steam, and hydro opportunities.

Electrification Segment to Support Growth

GE Vernova’s Electrification business is showing steady momentum, positioning itself as a key beneficiary of global grid modernization. In the second quarter of 2025, equipment backlog expanded by $2 billion, driven primarily by Europe, with North America and Asia both delivering nearly 10% sequential growth. Momentum is building in the Middle East as well, with a Saudi Arabia grid stabilization project expected to translate into at least $1.5 billion of orders next quarter. This highlights the rising demand for synchronous condensers, a long-standing GE technology now gaining traction. Management believes this niche could evolve into a $5 billion annual market.

Data center demand is another bright spot, with $500 million in orders secured in the first half of 2025 alone, already approaching last year’s full-year level. Electrification’s total backlog has swelled to $24 billion, up $6 billion year over year, despite a 31% drop in headline orders that reflects tough comparisons against outsized 2024 contracts. Underlying growth remains strong, supported by demand for switchgear in Europe and Asia, as well as expansion in high-voltage direct current systems.

With strong demand, productivity gains, and pricing power, the segment could deliver solid profitable growth in the coming years.

Conclusion: GEV Has More Room to Run

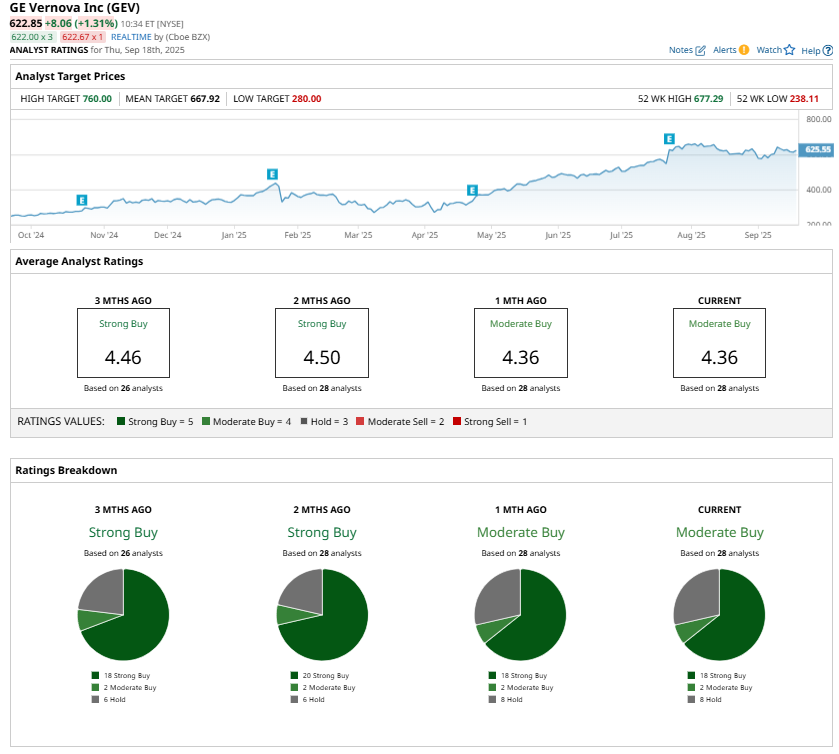

Analysts have a “Moderate Buy” consensus rating on GEV stock after the solid rally. However, the company’s strong backlog growth, rising global demand, and multiple tailwinds from electrification and decarbonization make its recent rally look sustainable.

Even after the sharp price increase, GEV’s valuations remain appealing thanks to its solid earnings growth outlook. GE Vernova stock trades at a forward price-earnings ratio of 81.06x. This appears warranted considering its growth potential. Analysts see GEV’s earnings per share climbing 217.5% in fiscal 2025, followed by another 71.13% jump in 2026, reflecting that the stock is still attractive.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.