- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Apple Iron Condor Could Profit 29% In Under 3 Weeks

/Apple%20watch%20on%20wrist%20by%20fancycrave1%20via%20Pixabay.jpg)

Apple (AAPL) is currently a compelling candidate for an iron condor strategy due to its elevated implied volatility percentile of 76%, indicating option premiums are rich relative to their historical levels.

This allows traders to collect more premium, increasing the potential return and providing a wider margin for error on both sides of the trade.

Additionally, AAPL has been trading in a relatively defined range recently, which aligns well with the neutral outlook of an iron condor.

The company’s strong liquidity ensures tight bid-ask spreads, making it easier to enter and adjust positions.

With no immediate earnings catalysts, the likelihood of a sharp move in either direction is reduced, further supporting the use of this strategy.

AAPL IRON CONDOR

An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range.

When implied volatility is high, the wider the expected range becomes.

The maximum profit for an iron condor is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Traders that think AAPL stock might stay in the current range over the next few weeks could look at an iron condor.

As a reminder, an iron condor is a combination of a bull put spread and a bear call spread.

The idea with the trade is to profit from time decay while expecting that the stock will not move too much in either direction.

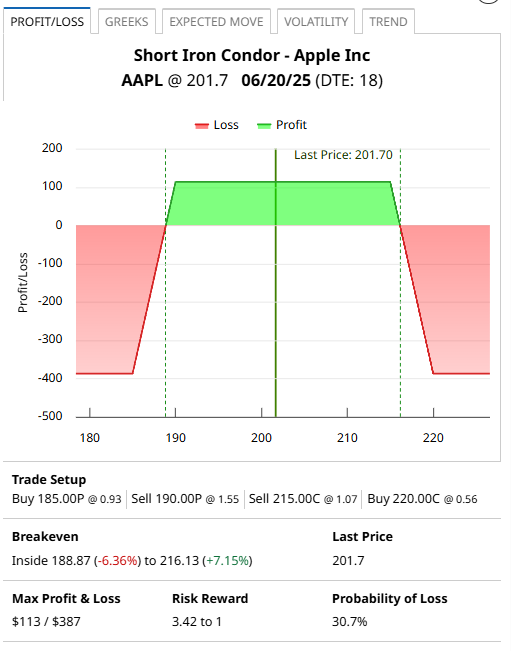

First, we take the bull put spread. Using the June 20 expiry, we could sell the $190 put and buy the $185 put. That spread could be sold yesterday for around $0.62.

Then the bear call spread, which could be placed by selling the $215 call and buying the $220 call. This spread could also be sold yesterday for around $0.51.

In total, the iron condor will generate around $1.13 per contract or $113 of premium.

The profit zone ranges between $188.87 and $216.13. This can be calculated by taking the short strikes and adding or subtracting the premium received.

As both spreads are $5 wide, the maximum risk in the trade is 5 – 1.13 x 100 = $387.

Therefore, if we take the premium ($113) divided by the maximum risk ($387), this iron condor trade has the potential to return 29.2%.

If price action stabilizes, then iron condors will work well. However, if AAPL stock makes a bigger than expected move, the trade will suffer losses.

The Expected move for Apple stock over the next 18 days is between 192.65 and 210.75, which is less than the profit range of this Condor.

COMPANY DETAILS

The Barchart Technical Opinion rating is a 100% Sell with a Average short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

AAPL rates as a Strong Buy according to 18 analysts with 4 Moderate Buy ratings, 12 Hold rating, 1 Moderate Sell rating and 2 Strong Sell ratings.

Apple's business primarily runs around its flagship iPhone.

However, the Services portfolio that includes cloud services, App store, Apple Music, AppleCare, Apple Pay & licensing and other services which become the cash cow.

Moreover, non-iPhone devices like Apple Watch and AirPod have gained significant traction.

In fact, Apple dominates the Wearables and Hearables markets due to the growing adoption of Watch and AirPods.

Solid uptake of Apple Watch also helps Apple to strengthen its presence in the personal health monitoring space.

Apple also designs, manufactures and sells iPad, MacBook and HomePod.

These devices are powered by software applications including iOS, macOS, watchOS and tvOS operating systems.

Apple's other services include subscription-based Apple News, Apple Card, Apple Arcade, new Apple TV app, Apple TV channels and Apple TV, a new subscription service.

Conclusion And Risk Management

One way to set a stop loss for an iron condor is based on the premium received. In this case, we received $113, so we could set a stop loss equal to the premium received, or a loss of around $113.

Another way to manage the trade is to set a point on the chart where the trade will be adjusted or closed. That could be around $190 on the downside and $210 on the upside.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.