- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Is Wall Street Bullish or Bearish on Gartner Stock?

/Gartner%2C%20Inc_%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Stamford, Connecticut-based Gartner, Inc. (IT) operates as a research and advisory company. It operates through Research, Conferences, and Consulting segments. With a market cap of $33.7 billion, Gartner’s operations span North America, EMEA, and the Indo-Pacific.

The IT service provider has significantly underperformed the broader market over the past year. Gartner’s stock has dropped 1.6% over the past 52 weeks and 9.5% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 10.2% gains over the past year and 1.3% dip in 2025.

Narrowing the focus, Gartner has also underperformed the industry-focused Vanguard Information Technology Index Fund ETF’s (VGT) 10.2% surge over the past year and 4.3% decline on a YTD basis.

Gartner’s stock prices rose 1.4% after the release of its better-than-expected Q1 results on May 6. The company’s topline increased 4.2% year-over-year to $1.5 billion, beating the company’s guidance and coming in line with market expectations. Meanwhile, the company’s effective cost management led to its margins and earnings beating expectations. While its adjusted EBITDA inched up by a modest 79 bps to $385 million, its adjusted EPS increased 1.7% year-over-year to $2.98, exceeding the consensus estimates by 9.6%. On an even more positive note, its free cash flows for the quarter grew 73.3% compared to the year-ago quarter, reaching $288 million, boosting investor confidence.

For the full fiscal 2025, ending in December, analysts expect Gartner to report a 10.3% year-over-year decline in adjusted EPS to $12.64. However, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

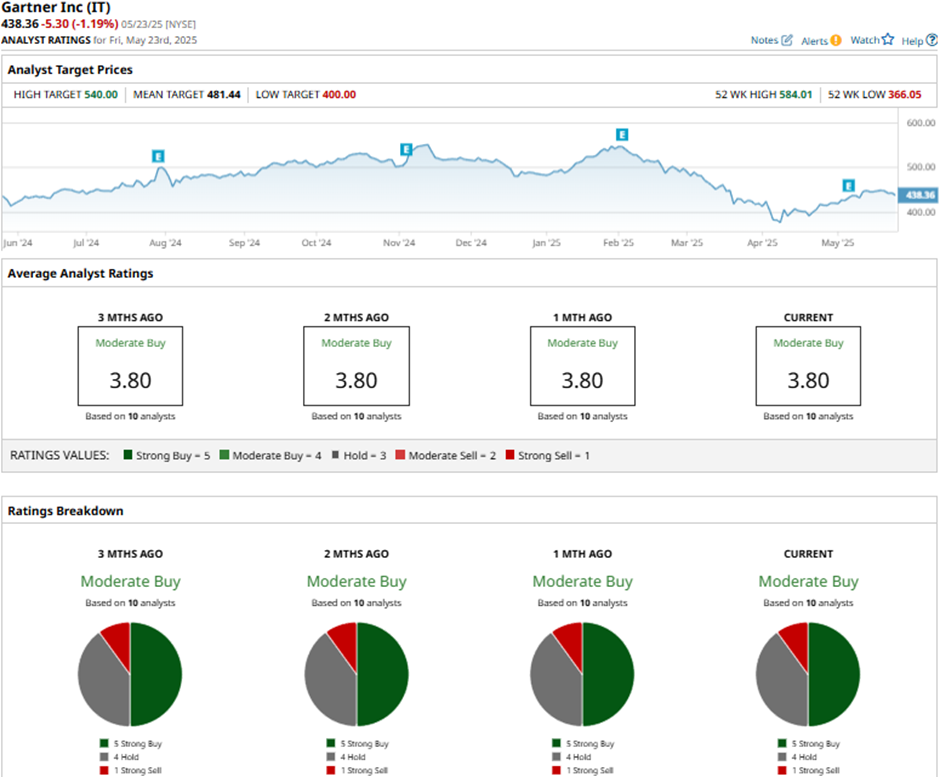

Among the 10 analysts covering the IT stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buys,” four “Holds,” and one “Strong Sell.”

This configuration has been stable in recent months.

On May 7, Goldman Sachs (GS) analyst George Tong maintained a “Buy” rating on Gartner, but lowered the price target from $622 to $535.

As of writing, Gartner’s mean price target of $481.44 represents a 9.8% premium to current price levels, while the street-high target of $540 suggests a 23.2% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.